With over 80% of Texas voters endorsing property tax cuts exceeding $18 billion in the November election, homeowners across the state are eagerly anticipating the promised relief in their wallets. However, understanding the intricacies of the state’s complex property tax laws can be a challenge for many, leaving them curious about when and how these tax cuts will manifest.

The approved scheme, a result of voter endorsement, entails local school districts lowering their tax rates, with the commitment that the state will compensate for the ensuing revenue loss. In addition, voters, responding to prompts from state lawmakers, supported an amendment increasing the homestead exemption amount—a mechanism safeguarding a portion of a homeowner’s property from taxes—and limiting the rise in property valuations.

Madison McMullen, a first-time homeowner in Lufkin, recognizes the potential long-term benefits of the approved tax cuts. As a single nurse navigating the complexities of homeownership, she hopes the savings will allow her to allocate more towards her mortgage principal, thereby expediting the payoff period.

“I’m trying to figure everything out,” McMullen explained. “I’m 25 years old and I don’t really know what I’m doing. This is all very new to me.”

McMullen’s journey into homeownership began in January 2022, driven by escalating rent costs. Despite challenges in finding an affordable home in her price range, she eventually secured her dream home—a three-bedroom, two-bathroom house—assisted by a special program for nurses, her Realtor, and a salary increase.

While the approved tax cuts are expected to bring relief, homeowners like McMullen are curious about when the savings will materialize. Local tax experts, including Bowie Central Chief Appraiser Mike Brower, shed light on the details.

Who Qualifies for Property Tax Savings and When? Homeowners paying school property taxes, either through a mortgage escrow or directly to the county’s tax assessor-collector, stand to benefit. Small businesses are also included, but renters are excluded from the equation, as landlords are not obligated to pass on any savings.

The homestead exemption, which protects a primary residence from taxes, applies only to properties serving as the primary residence. For those with multiple properties, the exemption is applicable to only one.

Property taxes are determined by applying the government-set rate to the appraised value of the home or property. Despite lower rates, Brower cautioned that some homeowners might not experience a significant reduction, or even see taxes plateau or increase, if the value of their home grew faster than the tax cut.

Lieutenant Governor Dan Patrick estimated annual savings for homeowners with an “average priced home” to be between $1,250 and $1,450. Zillow placed the average Texas home value at $298,424 as of October 31, 2023. Brower projected that homeowners in Bowie County, encompassing Texarkana, who purchased in 2021 or 2022, could save around $250 to $300 per year.

Have Taxing Entities Prepared for the Changes? Historically, when significant legislative changes occurred, entities lacked guidance on calculating owed taxes, resulting in varied outcomes for taxpayers. This year, the Legislature encouraged taxing offices to send bills based on the new laws, though entities retained flexibility in their approach.

For homeowners with paid-off homes, there’s a likelihood that local taxing authorities factored in potential changes when issuing property tax bills in October, anticipating voter approval of the proposed tax law adjustments.

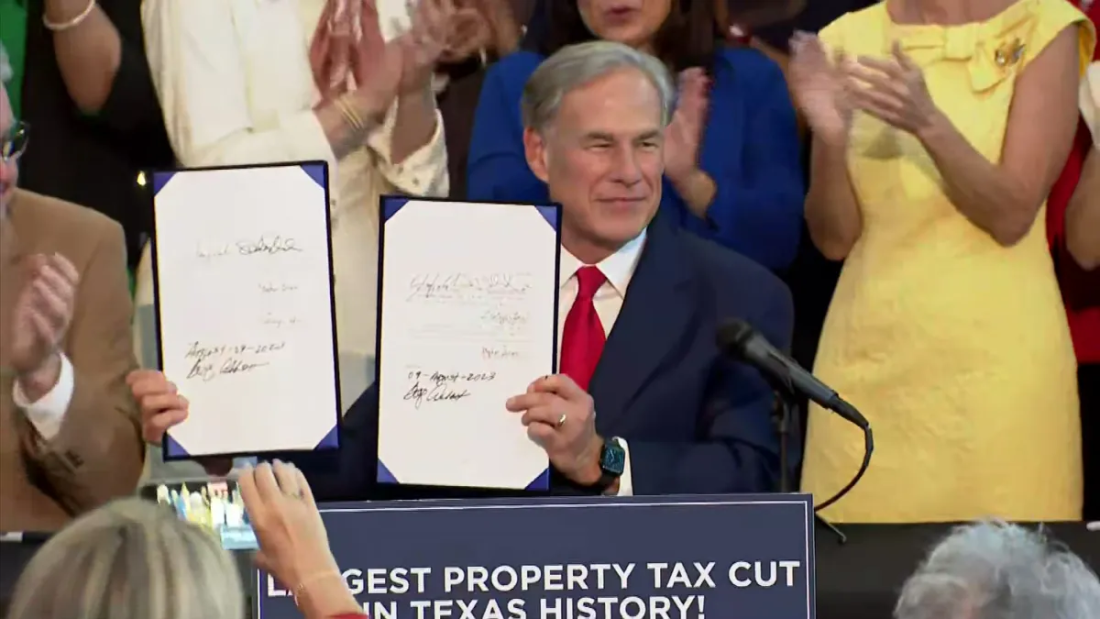

Will Lawsuits Impact the Implementation of Tax Cuts? Lawsuits challenging the election results allege issues with voting equipment certification and internet connectivity, leading to claims of an invalid election. While these lawsuits are expected to be dismissed, the timeline for resolution remains uncertain. Governor Greg Abbott and Secretary of State Jane Nelson argue the lawsuits are invalid due to technicalities, and a judge’s dismissal is deemed necessary before implementing the tax cuts.

Ensuring Receipt of Savings Homeowners can verify anticipated savings by contacting their local appraisal district or the tax assessor-collector’s office. Those paying taxes through a mortgage escrow should communicate with their lenders. Lenders are likely to notice a surplus in taxes paid and may refund the excess or adjust future payments.

While the annual escrow analysis typically causes monthly payments to increase, this year may see a decrease. Homeowners not wishing to wait for the annual review can request lenders to expedite the process.

Affordability Impact and Market Accessibility Real estate experts, such as Angie Williams, the Realtor who assisted McMullen, view the property tax changes positively. Anticipating a positive impact on affordability, Williams expects fewer individuals to be priced out of the market. The potential savings, although seemingly modest, could be significant for many buyers, making homeownership more accessible.

“For the average homeowner or for the majority of property owners and property searchers right now, it will make the decision of whether now is the time—if they can actually go ahead and move forward with a purchase at this point,” Williams said.

As Texans await the realization of these property tax cuts, the changes signal a potential shift in the real estate landscape, offering new opportunities for aspiring homeowners.