The Justice Department and Consumer Financial Protection Bureau (CFPB) have jointly filed a lawsuit against Colony Ridge, accusing the company of engaging in an illegal land sales scheme that allegedly targeted tens of thousands of Hispanic borrowers through deceptive practices and predatory loans.

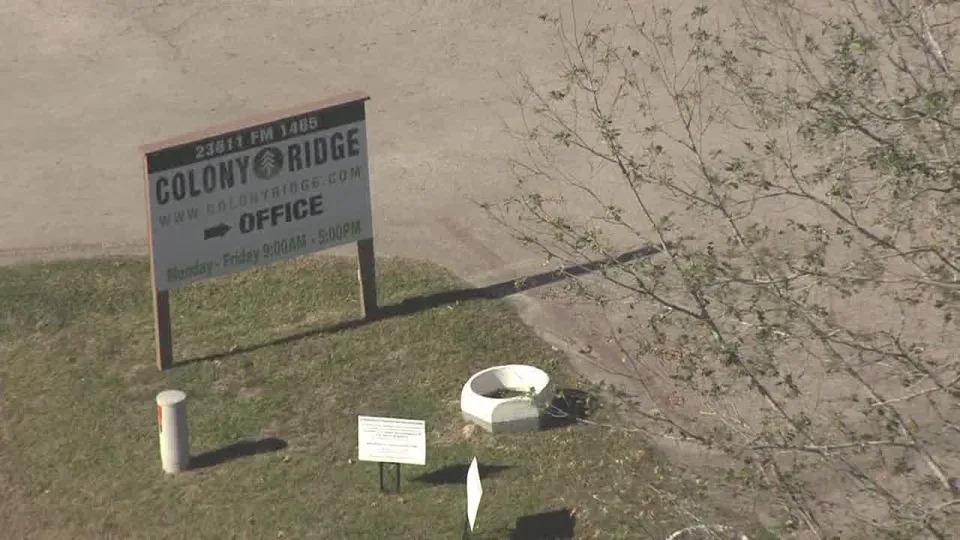

The lawsuit, filed in federal district court, focuses on Coloney Ridge’s operations in an unincorporated area of Liberty County, situated about 30 miles northeast of Houston. The company, responsible for developing over 40,000 lots, markets its subdivisions under “Terrenos Houston” and “Terrenos Santa Fe.”

One of the key accusations is that Colony Ridge misled borrowers about the infrastructure on the lots it sold. The complaint suggests that the company falsely represented that properties in the Terrenos Houston subdivisions came equipped with water, sewer, and electrical infrastructure. It is alleged that this critical information was only disclosed in English after applicants paid a non-refundable deposit.

Furthermore, the lawsuit contends that Colony Ridge sold flood-prone lots without adequately informing borrowers of the associated risks. Some properties in the Terrenos Houston subdivision reportedly experienced significant flooding during rain. This led to raw sewage running through or around borrowers’ properties and damaging personal belongings.

Colony Ridge is also accused of attracting Spanish-speaking borrowers through advertising, primarily in Spanish, on platforms like TikTok.

“Using 21st-century social-media applications to target and mislead consumers, Colony Ridge set out to exploit something as old as America — an immigrant’s dream of owning a home,” said U.S. Attorney Alamdar S. Hamdani for the Southern District of Texas (SDTX).

The company allegedly entices consumers with promises of an easy-to-obtain seller financing loan product that requires no credit check and only a small deposit. Exploiting language barriers during the sales process, the company is said to use high-pressure tactics to push borrowers into obtaining loans with exorbitant interest rates.

“Colony Ridge promised the American dream, but we allege that in reality, it has delivered a nightmare for thousands of hardworking Hispanic families who hoped to build their homes in the Terrenos Houston community,” said Assistant Attorney General Kristen Clarke of the Justice Department’s Civil Rights Division. “This lawsuit demonstrates our commitment to holding accountable those in the housing and financial industry who intentionally target and exploit homebuyers because they are Hispanic or don’t speak English well. Through our Combating Redlining Initiative, the Justice Department will aggressively continue to dismantle predatory, deceptive, and unfair lending practices to safeguard the rights of all who seek to buy a home.”

The lawsuit alleges that Colony Ridge engages in a foreclosure cycle, taking advantage of families falling behind on payments. This allows the company to repurchase and resell properties, often at higher prices.

Records indicate that Colony Ridge flipped a significant percentage of the properties it sold between September 2019 and September 2022, with some properties changing hands multiple times within a short period.

Colony Ridge is being prosecuted for allegations of unlawful discrimination against applicants based on race or national origin. This violates the Fair Housing Act (FHA) and the Equal Credit Opportunity Act (ECOA). Additionally, the company is accused of deceptive acts and practices, violating the Consumer Financial Protection Act of 2010 (CFPA) and the Interstate Land Sales Full Disclosure Act (ILSA).

Seeking legal redress, the lawsuit aims to halt Colony Ridge’s alleged unlawful conduct. It also aims to provide relief for affected consumers and impose a civil penalty payable to the CFPB victims relief fund. If found liable, restitution will be determined in federal court.

This legal action is part of the Justice Department’s Combating Redlining Initiative. This initiative addresses various forms of redlining, including reverse redlining, where communities of color are targeted with unfair lending terms. Notably, this lawsuit marks the first reverse redlining action under the initiative, signifying a significant step in addressing discriminatory practices in the housing and lending industry.